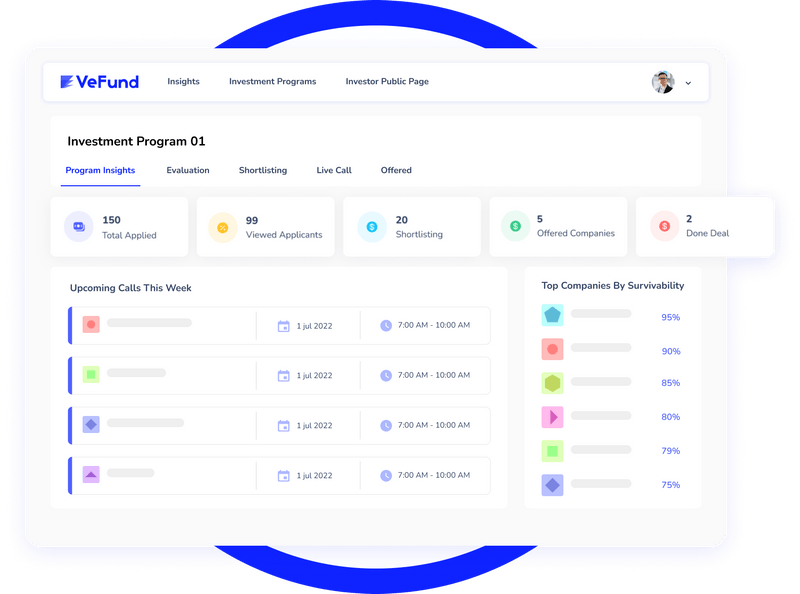

Take startup valuation to a new level with reliable methods and data sources

Use a simple, intuitive valuation calculator to help you value potential startups 5x faster using the latest market researches

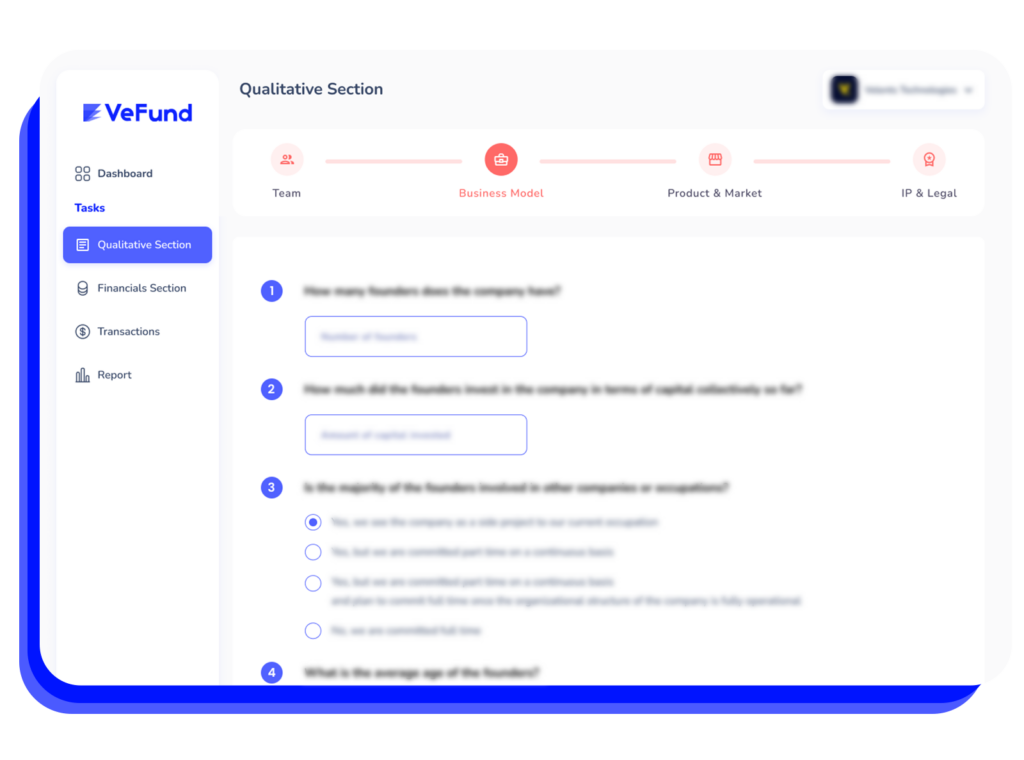

– Step 1

Answer the qualitative section

Answer a set of questions to evaluate the qualitative factors in the startup

How do you evaluate the qualitative aspects of a startup?

We use deterministic questions regarding the qualitative health of the startup. We compare the answers against an assumed average and maximal performing company and set the valuation relative to the home country’s average and maximum.

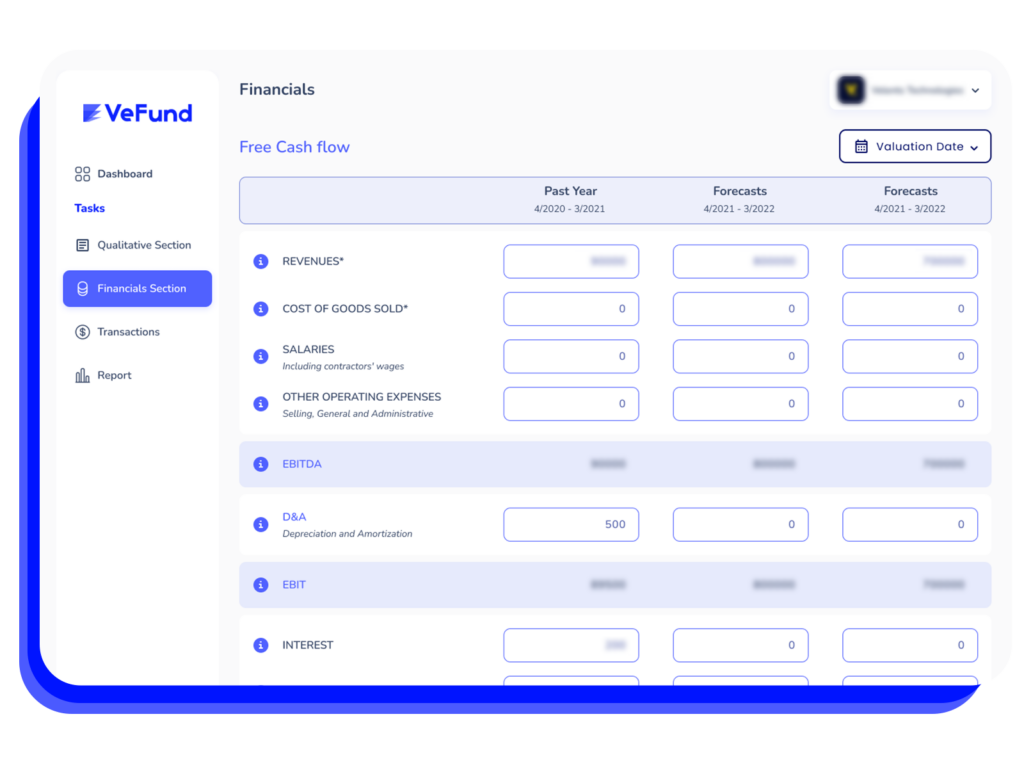

– Step 2

Input the financial projections

Value the company quantitatively using the best practices on quantitative valuation

How many countries and industries do you support with data?

We currently support 83 countries and 92 industries. The number is steadily growing. Even if you don’t find the country or industry you need, let us know so we can work on it!

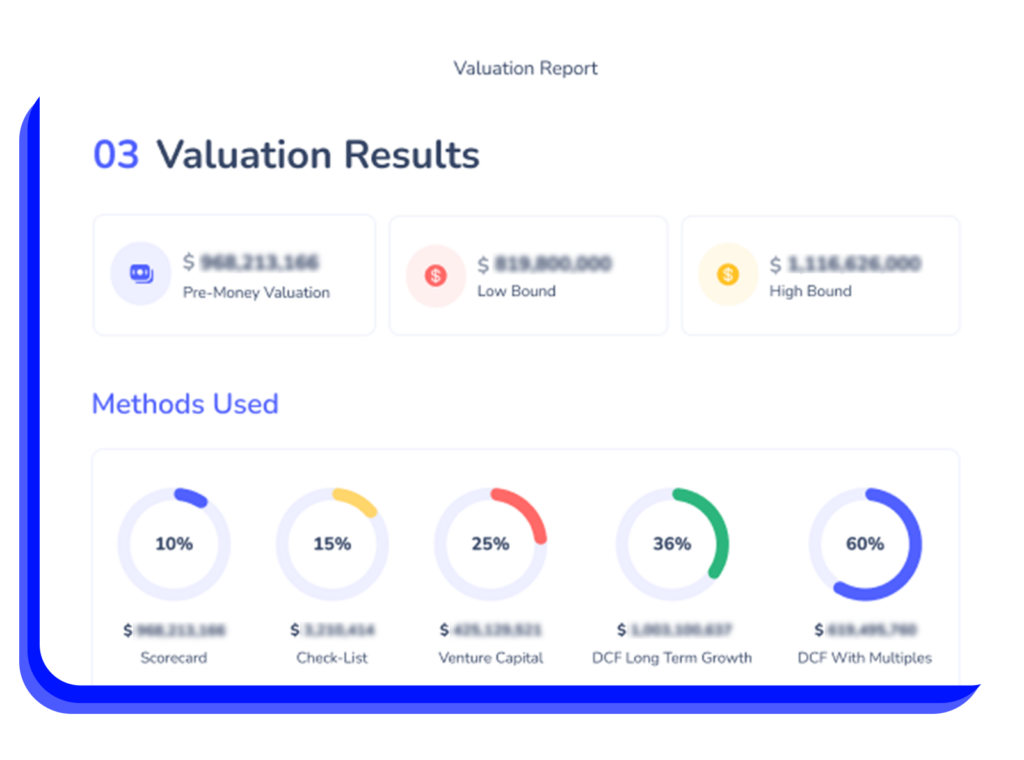

– Step 3

Generate detailed report

Generate a pdf report summarizing the startup’s valuation and the factors involved

Which stages of development do you support?

We support Preseed to Series A funding rounds. The earlier the stage of the company, the more we rely on qualitative valuation methods, and vice versa.